Green bonds: Fighting climate change in fixed income

Share

Achieving net zero means dramatically reducing global greenhouse emissions and compensating for any residual emissions by reabsorbing the same amount from the atmosphere. It requires a major shift in how investors allocate capital, and how they engage with companies to turn well-meaning ideas into action.

Here we explore one option that investors have to start their own climate transition. This involves mobilising some of the $127trn accumulated in the global bond market1.

We’re talking about ‘green bonds’, a relatively small but booming segment of the bond market. Green bonds offer investors a way to direct some of their capital towards climate projects. As we’ll see, the rationale for including them in portfolios is stronger than ever.

First things first: how do they work?

Investing with purpose

When you buy a normal or ‘vanilla’ bond, you’re lending your money to the issuing company or government with no strings attached. The issuer uses the proceeds for an unspecified purpose, and pays a coupon on the bond in return. Eventually—in most cases—you get your principal (loan) back.

Green bonds, in contrast, raise money for a specified purpose. For a bond to be certified as green, its proceeds must help fund climate or environmental projects. So, unlike with a vanilla bond, you will always know where your money is going. You can think of it as financing with ‘green strings attached’.

A green bond could be financing a new windfarm, or a project to increase a low-lying town’s flood resilience, or a train station refurbishment which boosts public transport use – any of a wealth of projects that will go on to benefit the environment in a specific, tangible way.

Put simply, green bonds offer much more transparency and measurability than normal bonds. Yet they still fly under the radar for many investors. Many, that is, but not all. Away from the mainstream, the green bond market has been booming in popularity.

For investors, there are several things worth knowing about this growing segment of the market.

Why green bonds are going mainstream

Speak to any climate activist and you’ll hear the fight against climate change is slow – too slow. One reason why is because climate projects need to be financed, and there hasn’t been a good mechanism for connecting investor cash with the green projects that need it most.

Let’s consider for a moment what climate-action or mitigation projects involve. This could be capital expenditure for new infrastructure, or major changes to existing systems, or investment in developing technologies. It all costs money, and sometimes that money is hard to find.

Green bonds open up a channel to deliver

much-needed funding directly to green projects.

But it’s not an act of charity – these are investments, and so they come with a return. Just like their vanilla counterparts, green bonds pay a coupon. After all, a windfarm will generate and sell electricity. A new transport hub will process thousands of paying passengers. Flood resilience is worth paying for today if it reduces future costs. Investing in the energy transition is still investing.

That’s why, even putting environmental concerns aside, green bonds can be an attractive investment. They offer returns and diversify portfolio risk while contributing to climate action in a measurable way. And they are being rapidly snapped up by investors waking up to the fact that environmental benefits don’t have to come at a premium.

Investors are waking up to the potential

Green bonds are still a small part of the giant global bond market, but they’re on a very strong growth trajectory. Since the inception of the green bond market in 2007, global cumulative issuance has reached $2.3 trillion2.

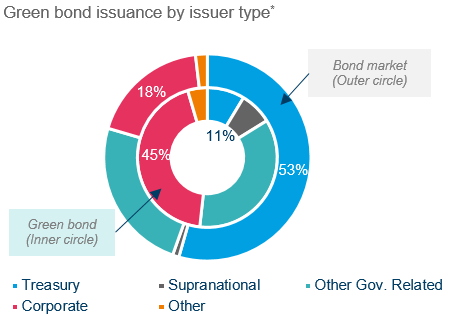

Of note is the issuer mix for green bonds (the proportion of green bond issuers that are corporate, sovereign, local government, etc.) which is very different from the overall bond market. Just 11% of total issuance is from sovereign issuers – national governments – versus 53% in the global bond market. The reverse is true for corporate issuance: 45% of green bonds are issued by corporations, versus 18% in the global bond market.

Source: Bloomberg, Amundi as of 31/03/2023. *BClass classification. Green Bond as defined by Bloomberg. Past performance is not a reliable indicator of future performance.

We believe sovereign green bond issuance will rise further, bringing the issuer mix closer to what we see in the global bond market and increasing the size and diversity of the bonds on offer to investors.

Sovereign green bonds are increasingly used help to fund government investments in projects with environmental objectives (mostly climate change mitigation). In 2022, clean transport was the main beneficiary (almost 50%) of investment from green bond issuance by euro area governments, followed by energy efficiency (including green construction) and renewable energy which together represent a third of allocations. Progress has also been made in strengthening green capital markets with the European Green Bond Standard designed that aims to increase and expand the environmental ambitions of the green bond market.

With energy independence and security rapidly climbing the governmental agenda, even more may decide to issue green bonds to finance the transition, rather than rely on external fuel sources or less direct funding. That could create an interesting evolution of the market and offer new opportunities for fixed income investors.

Positive investing with a green bond ETF

Green bonds are a way for investors to get more certainty about the effect they make. With “use of proceeds” rules and impact reporting, they can be sure they’re funding green projects.

It means green bonds are both a powerful and positive investment. For all the alarming statistics on global warming, humanity still has a big opportunity to limit climate change before it’s too late. Scientific research has determined +1.5°C as the point after which there would be a catastrophic impact on the environment, our societies and life on earth. There’s a phenomenal amount of investor cash that could be mobilised to help keep warming at or below 1.5°C.

Green bonds provide a route forward to shift those trillions into projects where they will make the most difference.

Of course, for most people it’s not practical to buy and sell individual green bonds. Fortunately, specialist green bond ETFs offer an efficient alternative, bringing together labelled green bonds and providing them for investment in a simple ETF wrapper. The Lyxor Green Bond (DR) UCITS ETF (ticker: CLIM) is the original, and still by far the largest with €613 million under management2.

We measure and report on CLIM’s allocation of proceeds. In 2022, the top three sectors to receive proceeds from the Lyxor Green Bond (DR) UCITS ETF were Energy (41%), Green Buildings (28%) and Clean Transport (14%)3.

1. Energy

Electricity and heat production from renewable sources, transmission and smart grid infrasctructure, energy storage, etc.

2. Green Buildings

Construction of refurbishment of tertiary or residential buildings with low energy consumption certification, etc.

3. Clean Transport

Rail transport systems for merchandise or passengers, electric or alternative fuel vehicles, bicycle infrastructures, etc.

Please note: The approach implemented by the Lyxor Green Bond (DR) UCITS ETF by investing in green bonds is largely based on third party data that may be incomplete, inaccurate or unavailable from time to time, and which make it dependent on the quality and reliability of such information. Investment in green bonds may also induce sectoral biases in the global bond market. For more information, please refer to the prospectus of the fund.

Adding green bonds to your portfolio

The green bond market is relatively small but fast developing, offering a plethora of potential opportunities for fixed income investors.

As illustrated in the table below, we provide a growing number of options for adding green bonds to a portfolio.

Information on Amundi’s responsible investing can be found on amundietf.com and amundi.com. The investment decision must take into account all the characteristics and objectives of the Fund, as described in the relevant Prospectus.

1. Source : SIFMA, Capital Markets Factbook 2022, data as of 31 December 2021

2. Source : https://www.climatebonds.net/

3. Source: Amundi. Lyxor Green Bond ETF Range: Impact Report 2022

Knowing your risk

It is important for potential investors to evaluate the risks described below and in the fund’s Key Investor Document (“KID”) and prospectus available on our website www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

Important information

This material is solely for the attention of professional and eligible counterparties, as defined in Directive MIF 2014/65/UE of the European Parliament (where relevant, as implemented into UK law) acting solely and exclusively on their own account. It is not directed at retail clients. In Switzerland, it is solely for the attention of qualified investors within the meaning of Article 10 paragraph 3 a), b), c) and d) of the Federal Act on Collective Investment Scheme of June 23, 2006.

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Funds or in the legal mentions section on www.amundi.com and www.amundietf.com. The Funds have not been registered in the United States under the Investment Company Act of 1940 and units/shares of the Funds are not registered in the United States under the Securities Act of 1933.

This material reflects the views and opinions of the individual authors at this date and in no way the official position or advices of any kind of these authors or of Amundi Asset Management nor any of its subsidiaries and thus does not engage the responsibility of Amundi Asset Management nor any of its subsidiaries nor of any of its officers or employees. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is explicitly stated that this document has not been prepared by reference to the regulatory requirements that seek to promote independent financial analysis. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Neither Amundi Asset Management nor any of its subsidiaries accept liability, whether direct or indirect, that may result from using any information contained in this document or from any decision taken the basis of the information contained in this document. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research.

This document is of a commercial nature. The funds described in this document (the “Funds”) may not be available to all investors and may not be registered for public distribution with the relevant authorities in all countries. It is each investor’s responsibility to ascertain that they are authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice.

This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of its subsidiaries.

The Funds are Amundi UCITS ETFs. The Funds can either be denominated as “Amundi ETF” or “Lyxor ETF”. Amundi ETF designates the ETF business of Amundi.

Amundi UCITS ETFs are passively-managed index-tracking funds. The Funds are French, Luxembourg open ended mutual investment funds respectively approved by the French Autorité des Marchés Financiers, the Luxembourg Commission de Surveillance du Secteur Financier, and authorised for marketing of their units or shares in various European countries (the Marketing Countries) pursuant to the article 93 of the 2009/65/EC Directive.

The Funds can be French Fonds Communs de Placement (FCPs) and also be sub-funds of the following umbrella structures:

For Amundi ETF:

- Amundi Index Solutions, Luxembourg SICAV, RCS B206810, located 5, allée Scheffer, L-2520, managed by Amundi Luxembourg S.A.

For Lyxor ETF:

- Multi Units France, French SICAV, RCS 441 298 163, located 91-93, boulevard Pasteur, 75015 Paris, France, managed by Amundi Asset Management

- Multi Units Luxembourg, RCS B115129 and Lyxor Index Fund, RCS B117500, both Luxembourg SICAV located 9, rue de Bitbourg, L-1273 Luxembourg, and managed by Amundi Asset Management

- Lyxor SICAV, Luxembourg SICAV, RCS B140772, located 5, Allée Scheffer, L-2520 Luxembourg, managed by Amundi Luxembourg S.A.

Before any subscriptions, the potential investor must read the offering documents (KID and prospectus) of the Funds. The prospectus in French for French UCITS ETFs, and in English for Luxembourg UCITS ETFs, and the KID in the local languages of the Marketing Countries are available free of charge on www.amundi.com, www.amundi.ie or www.amundietf.com. They are also available from the headquarters of Amundi Luxembourg S.A. (as the management company of Amundi Index Solutions and Lyxor SICAV), or the headquarters of Amundi Asset Management (as the management company of Amundi ETF French FCPs, Multi Units Luxembourg, Multi Units France and Lyxor Index Fund). For more information related to the stocks exchanges where the ETF is listed please refer to the fund’s webpage on amundietf.com.

Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KID and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.

It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects).

Please note that the management companies of the Funds may de-notify arrangements made for marketing as regards units/shares of the Fund in a Member State of the EU or the UK in respect of which it has made a notification.

A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation with respect to Amundi ETFs.

This document was not reviewed, stamped or approved by any financial authority.

This document is not intended for and no reliance can be placed on this document by persons falling outside of these categories in the below mentioned jurisdictions. In jurisdictions other than those specified below, this document is for the sole use of the professional clients and intermediaries to whom it is addressed. It is not to be distributed to the public or to other third parties and the use of the information provided by anyone other than the addressee is not authorised.

This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material.

Updated composition of the product’s investment portfolio is available on www.amundietf.com. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them.

Indices and the related trademarks used in this document are the intellectual property of index sponsors and/or its licensors. The indices are used under license from index sponsors. The Funds based on the indices are in no way sponsored, endorsed, sold or promoted by index sponsors and/or its licensors and neither index sponsors nor its licensors shall have any liability with respect thereto. The indices referred to herein (the “Index” or the “Indices”) are neither sponsored, approved or sold by Amundi nor any of its subsidiaries. Neither Amundi nor any of its subsidiaries shall assume any responsibility in this respect.

In EEA Member States, the content of this document is approved by Amundi for use with Professional Clients (as defined in EU Directive 2004/39/EC) only and shall not be distributed to the public.

Information reputed exact as of the date mentioned above.

Reproduction prohibited without the written consent of Amundi